The course LAW 6001 is designed to introduce students to the basic concepts and fundamentals of taxation law. This course focuses on taxes on income, capital gains, economic incentives, government revenue, tax system, federal taxation, estate, gift tax, etc. The programs like (L.L.M) are offered in Canada, US, UK, Australia, etc. Theses programs focus on domestic, international taxation, employee taxation, corporate taxation, etc. Taxation demands a high level of commitment and understanding as it involves a variety of assignments. However, availing of taxation assignment help from trained experts can help you to understand more about it.

Taxation Law Assignment Case Study Guide

Mainly taxation law case studies assessments to be written under 2500- 3000 words. To solve taxation law assignments you need to do a lot of research.

As per the law assignment helpexperts, assignment questions come like this where you need to identify the question through facts and relate it with legal issues. Read the below article to know how can you solve questions like this.

Easiest Approach To Solve Law 6001 Taxation Case Study

You need to be careful while solving taxation assignment questions. If you want to solve your assignments on your own then you have to acquire research skills and have to gain expertise to solve your legal issues. Remember, case study needs research, time and knowledge to draft answers as per the guidelines of the university.

Let’s look out the questions that are recently solved by the team of our experts for your reference purpose.

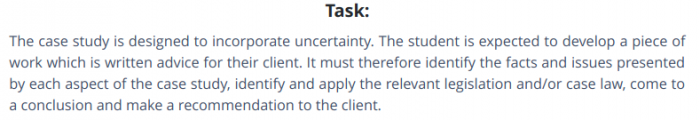

Question 1:

The image given below has the case study of Adam Collins. As per the guidelines of a university professor, they need to solve the given case study by the help of law provisions. First, you need to explain the Domicile test and the superannuation test that applies to all the Australian Government Empoyees.

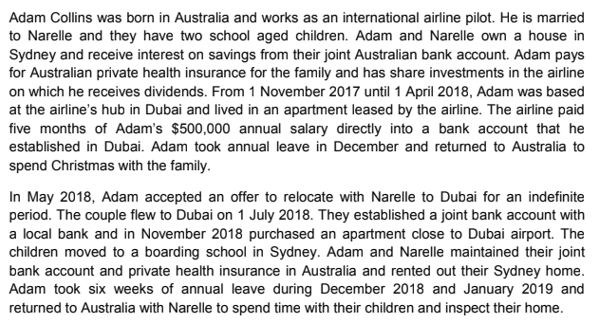

Question 2:

The given case is about where students have to solve the total number of floor areas of the house and calculate the occupancy rates. In this case study, you need to do research on different section numbers to explain your point. Mainly, most of the students face difficulty in solving this type of case study due to which they seek assistance from law assignment help experts.

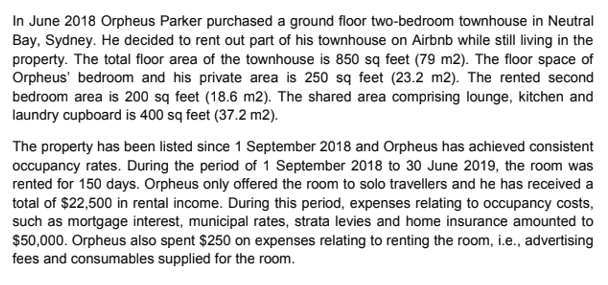

Question 3:

This case study is based on Joe Messina. Basically, to solve the case study you need to follow the same approach solve in the previous case study.

To solve this question you need to learn about the capital gain taxes and capital assets. There are several methods to solve this type of case studies therefore before solving these questions, first read the guidelines well.

Want to get the solution of Law 6001 Taxation Case Study click on the link below:

Law 6001 Taxation Case Study Solution

Secure A+ Grade In LAW 6001 Taxation Law Assignment By Seeking Assistance From Experts?

If you have gone through this article, then you may not find complexity as you used to find it initially. This is only a 20% of LAW 6001 Taxation Law Assignments, to get the complete solution of this case study contacts us at Sample Assignment. While sitting back and relax, our experts will do their work to help and understand every concept related to LAW 6001 Taxation Law Assignment.

Give us a call at Sample Assignment to get the best assistance.